[ad_1]

While it may be easy to assume that having more money would make a person happier by opening consumption opportunities unavailable to those with less income, experienced advisors can likely identify many examples of high-income individuals who are unhappy with their lives. To provide a more holistic view, researchers have sought to assess whether increased income leads to greater happiness on two dimensions: emotional wellbeing (how an individual feels today) and evaluative wellbeing (how an individual feels about their life overall).

An oft-cited 2010 study by Daniel Kahneman and Angus Deaton found that while overall life evaluation was positively correlated with income (even at levels exceeding $120,000), emotional wellbeing only increased up to $75,000 of income, plateauing after that point. This suggested that, after a certain point, increased income would not necessarily increase an individual’s day-to-day happiness. However, a 2021 study by Matthew Killingsworth using a more granular measurement scale found that day-to-day wellbeing continues to increase even beyond income levels exceeding $75,000 (while also finding that overall life evaluation increases with higher income as well).

When it comes to financial advisors, in particular, Kitces Research found a similar positive correlation between income and happiness. For instance, our research found that not only is advisor take-home income positively correlated with overall life satisfaction, but also that, similar to Killingsworth’s findings, their income is positively correlated with positive feelings and negatively correlated with negative feelings, even as income exceeds $75,000.

Importantly, there are other factors that can mediate the relationship between income and happiness, which may explain why higher income doesn’t always lead to greater happiness. For instance, Killingsworth found that respondents increasingly reported that they did not have enough time to get things done as their income rose, serving as a small but significantly negative mediator of the association between income and experienced wellbeing. This concept of ‘time poverty’ also appears to apply to financial advisors, as Kitces Research has found that the number of hours an advisor works in a given week is inversely correlated with their wellbeing.

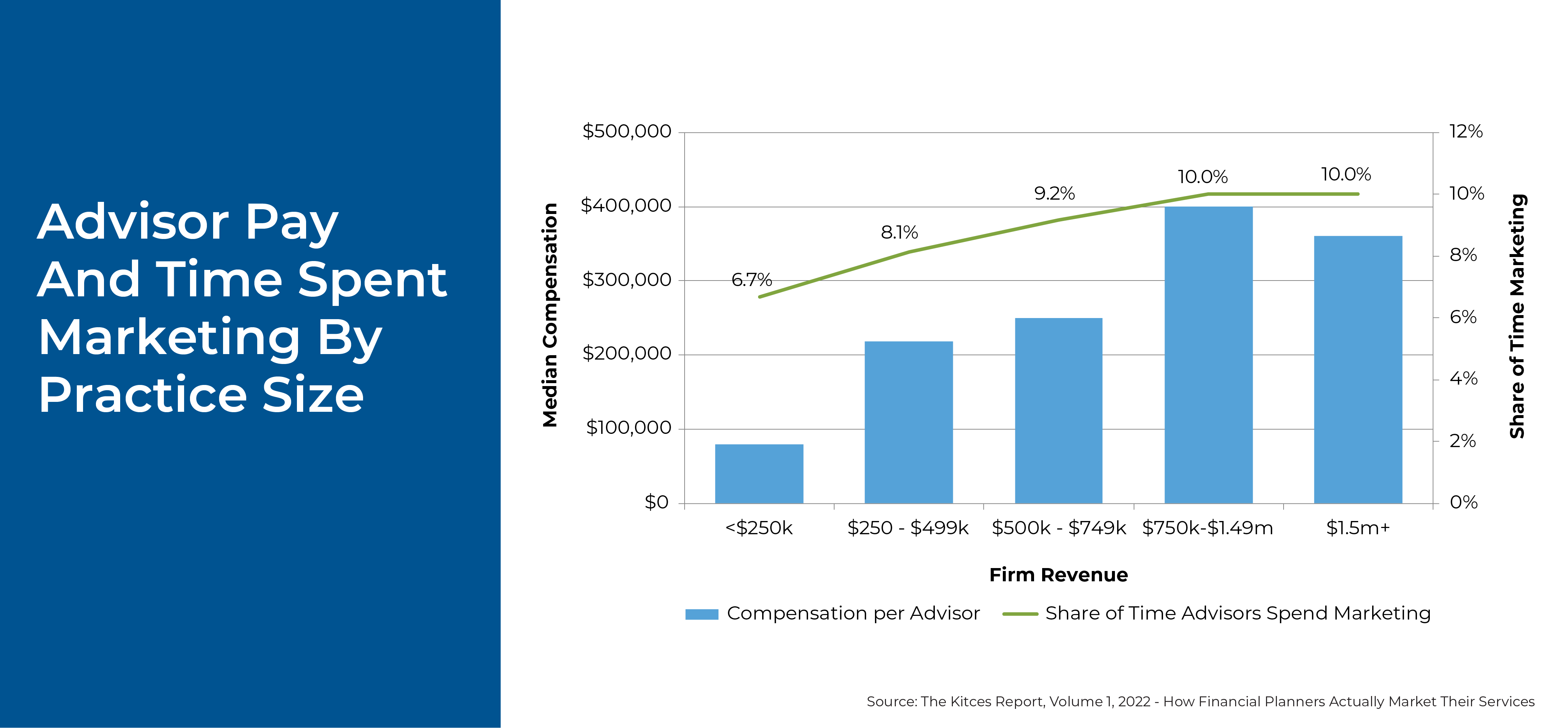

These findings suggest that advisors who choose to pursue increased income in the pursuit of greater experienced happiness may be more successful if they deliberately protect the time they have available for their other responsibilities and interests. A few ways that can help advisors do this include adding staff as their firm reaches certain revenue ‘pain points’ where they have too much work on their plate, and allocating more ‘hard dollars’ paid to outside vendors for marketing services as the firm grows, allowing firm owners to use their time for more valuable and/or enjoyable activities.

Ultimately, the key point is that as an advisor’s income increases, their wellbeing – in terms of both day-to-day happiness and overall life evaluation – can potentially increase as well. But if higher income comes with increased demands on the advisor’s time, particularly if they get to the point where they feel they don’t have time to finish everything they need to get done, the experienced ‘time poverty’ can have a negative effect on the advisor’s wellbeing. In the end, time is the ultimate scarce resource, and it is important for advisors to spend it wisely, particularly as their income increases!

[ad_2]

Image and article originally from feeds.feedblitz.com. Read the original article here.