[ad_1]

By Vincent Cignarella, Bloomberg Markets Live commentator and reporter

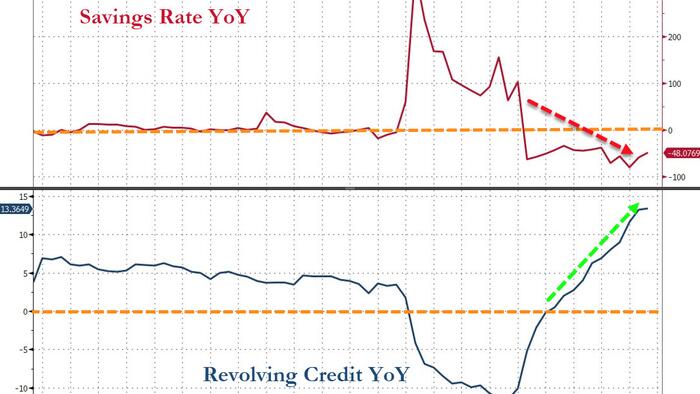

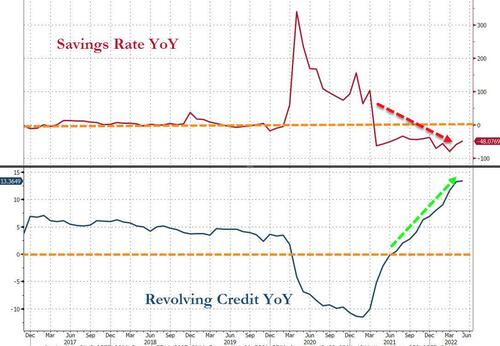

The US personal savings rate is near a five-year low as pandemic fiscal stimulus savings run dry.

But consumers are still spending with credit.

How long can consumers keep spending with revolving credit at the highest level in decades?

The risk is that equity markets have a lot more room to the downside.

The danger is that consumer spending, which drives some 70% of GDP, will soon be tapped out.

Lower spending, lower earnings with lower economic growth, while inflation is still running hot, will likely leave equities nowhere to go but down.

[ad_2]

Image and article originally from www.zerohedge.com. Read the original article here.