[ad_1]

Japanese Yen Talking Points

USD/JPY carves a series of lower highs and lows after failing to test the September 1998 high (139.91), but the Bank of Japan (BoJ) interest rate decision may prop up the exchange rate as the central bank remains reluctant to move away from its easing cycle.

USD/JPY Pullback Emerges Ahead of BoJ Interest Rate Decision

USD/JPY continues to pullback from the yearly high (139.39) on the back of US Dollar weakness, and the exchange rate may face a further decline ahead of the BoJ meeting amid waning expectations for a 100bp Federal Reserve rate hike.

Nevertheless, more of the same from the BoJ may prop up USD/JPY as Governor Haruhiko Kuroda and Co. stick to the Quantitative and Qualitative Easing (QQE) Program with Yield Curve Control (YCC), and the exchange rate may continue to exhibit a bullish trend over the remainder of the year amid the diverging paths for monetary policy.

In turn, USD/JPY may continue to trade to multi-decade highs as the Federal Open Market Committee (FOMC) shows a greater willingness to implement a restrictive policy, while the tilt in retail sentiment looks poised to persist as traders have been net-short the pair for most of 2022.

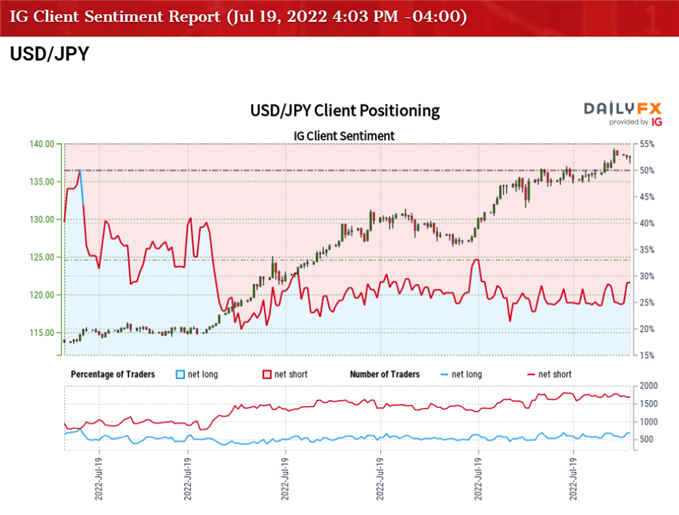

The IG Client Sentiment report shows 28.86% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 2.46 to 1.

The number of traders net-long is 6.44% higher than yesterday and 0.90% lower from last week, while the number of traders net-short is 3.95% lower than yesterday and 4.63% lower from last week. The decline in net-long position comes as USD/JPY carves a series of lower highs and lows, while the drop in net-short interest has helped to alleviate the crowding behavior as 25.13% of traders were net-long the pair last week.

With that said, USD/JPY may face a larger pullback ahead of the BoJ rate decision amid the failed attempt to test the September 1998 high (139.91), but the decline from the yearly high (139.39) may turn out to be a correction in the broader trend amid diverging paths for monetary policy.

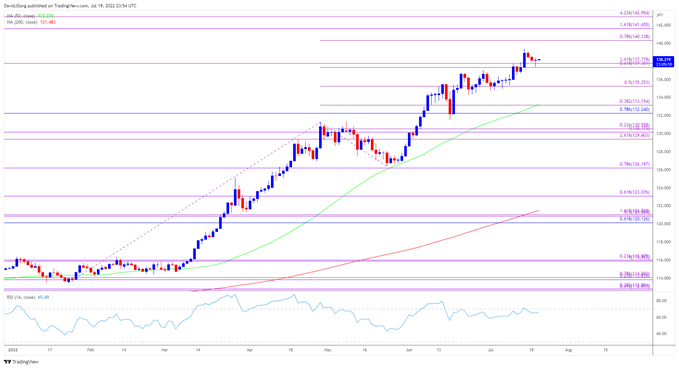

USD/JPY Rate Daily Chart

Source: Trading View

- USD/JPY appears to have reversed course ahead of the September 1998 high (139.91) as it carves a series of lower highs and lows, with the Relative Strength Index (RSI) quickly falling back from overbought territory after climbing above 70 for the sixth time this year.

- A break/close below the 137.40 (61.8% expansion) to 137.80 (316.8% expansion) region may push USD/JPY towards the 135.30 (50% expansion) area, with a break of the monthly low (134.74) opening up the Fibonacci overlap around 132.20 (78.6% retracement) to 133.20 (38.2% expansion).

- However, failure to break/close below the 137.40 (61.8% expansion) to 137.80 (316.8% expansion) region may spur another run at the September 1998 high (139.91), with the next area of interest coming in around 140.30 (78.6% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

[ad_2]

Image and article originally from www.dailyfx.com. Read the original article here.